Story

When you picture an accountant, you likely envision a character that is highly organized, detail oriented, and stuck in time. You picture excel worksheets, complex calculations, and boring colors.

In reality, accountants have been evolving over the years, and technology is enabling a completely new era of accountants… the Digital Accountants! Online Taxman’s NFTs are modern day adaptations of Digital Accountants.

We created this Collection to represent how Online Taxman prepares for the new digital space, while adding our Team’s modern essence, global diversity, and color.

When you mint an NFT in our collection, you join the Online Taxman’s crypto community. You get access to a connected global community of accountants that make crypto tax reporting easy. You’re minting a character that represents the evolution of accounting firms around the world, while accessing exclusive benefits on Online Taxman’s crypto services.

How to Mint an NFT in Online Taxman’s Collection

The process to get your NFT (also known as minting) is very simple. You just need to follow 5 basic steps, explained below:

1. Create a Crypto Wallet

First of all, it’s important to understand that NFTs operate on the blockchain, and therefore require you to have a crypto wallet to transfer and store NFTs, and buy and sell them.

If you do a simple Google search, you’ll find tons of wallets to choose from, but some of the most popular wallets are MetaMask and Coinbase Wallet. Simply pick the wallet of your choice, download it, and get set up.

2. Fund Your Crypto Wallet

When you turn your digital work into an NFT, you are essentially recording a transaction on the blockchain, which requires the network to do some work, costing you money. This small fee is called a “gas fee.”

To make sure you’re able to pay for this fee and mint your NFT, you need to have enough cryptocurrency in your account to cover the cost. You’ll need to buy some Ethereum (or whichever crypto you plan on using), which you can easily do within MetaMask or Coinbase Wallet.

Note that gas fees aren’t a fixed amount and are dependent on the price the network is charging at the moment. On average, you can expect to pay around $100-150 to mint each NFT.

3. Connect Your Crypto Wallet to Online Taxman’s NFT Drop Dapp

When you click “Connect Wallet” on the NFT Drop Dapp it will automatically ask you to connect your wallet. Simply click the wallet you created to connect it to the Drop Dapp and follow the instructions.

As a reminder, please make sure you are using the Polygon network. Otherwise, a message asking to switch networks will show up (see screenshot below). You can easily add the Polygon network to your wallet by connecting it with ChainList and clicking the “Add to Wallet” button.

4. Get Your Online Taxman NFT

Once you have set up a wallet, funded it, and connected it to the NFT Drop App using right network (Polygon), it’s pretty simple to get your Online Taxman NFT!

5. Congrats!

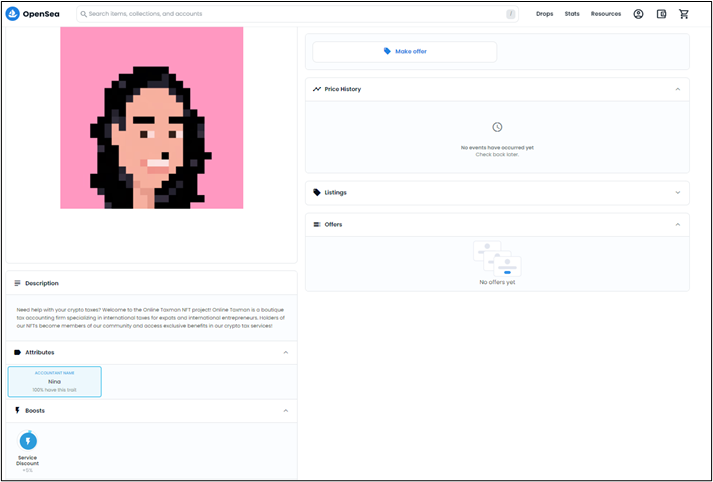

You’ve minted an NFT from Online Taxman’s Collection! Your NFT will live in the Polygon Blockchain forever and can be visited it on our OpenSea Collection.

All of our NFTs come with a random % discount on our crypto tax services. In OpenSea you will be able to see how much yours has!

Community Benefits

Tax Service Discount (applied to crypto tax services only, see below).

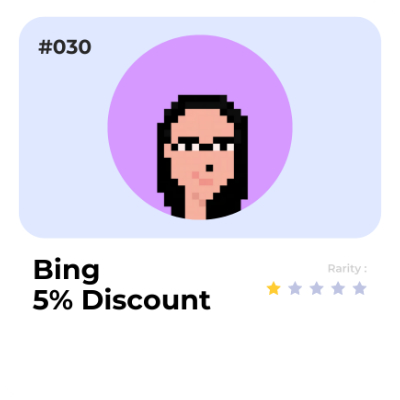

5% DISCOUNT(200/300) |

66.67% chance |

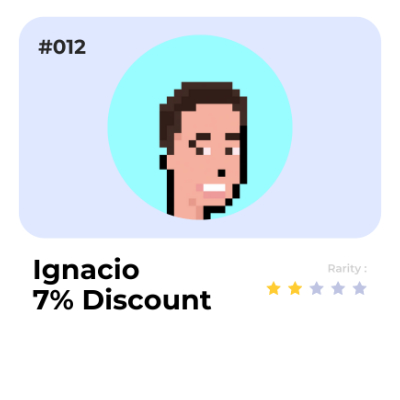

7% DISCOUNT(50/300) |

16.67% chance |

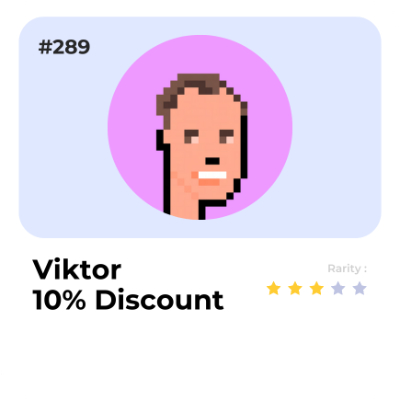

10% DISCOUNT(28/300) |

9.33% chance |

15% DISCOUNT(17/300) |

5.67% chance |

20% DISCOUNT(5/300) |

1.66% chance |

Why Do Your Crypto Taxes With Us

Other crypto tax solutions typically require you to input your data into their tax software. You’re basically on your own there, doing the formatting and troubleshooting yourself. With Online Taxman however, you work with a crypto tax accountant and reconciliation specialist. Our personalized service ensures that your tax return is done correctly.

Our Tax Packages

Starter

For centralized exchange transactions ONLY- Up to 5,000 centralized exchange transactions

- Up to 1,000 blockchain transactions

- Up to 3 centralized exchanges

- Wallets/chains

- Consultation with a tax accountant

- 8949 report, Schedule D

- Income report

- Missing data analysis

- Tax optimization (FIFO, LIFO, Specific ID)

- Cryptocurrency tax expert support

- Staking, airdrops, and rewards

- Support for DeFi platforms

- FBAR (FinCEN Form 114)

- NFT transactions

- Liquidity pools (LP tokens)

- Cryptocurrency lending/borrowing

- Mining and masternode business

- Futures and leverage trading

- Synthetic tokens

- IDOs/ICOs (Initial Coin Offerings)

- VIP Service (priority list)

Basic

For simple cryptocurrency tax reconciliations- Up to 5,000 centralized exchange transactions

- Up to 1,000 blockchain transactions

- Up to 3 centralized exchanges

- Up to 1 wallet/chain

- Consultation with a tax accountant

- 8949 report, Schedule D

- Income report

- Missing data analysis

- Tax optimization (FIFO, LIFO, Specific ID)

- Cryptocurrency tax expert support

- Staking, airdrops, and rewards

- Support for DeFi platforms

- FBAR (FinCEN Form 114)

- NFT transactions

- Liquidity pools (LP tokens)

- Cryptocurrency lending/borrowing

- Mining and masternode business

- Futures and leverage trading

- Synthetic tokens

- IDOs/ICOs (Initial Coin Offerings)

- VIP Service (priority list)

Standard

For crypto traders operating across multiple exchanges and wallets- Up to 10,000 centralized exchange transactions

- Up to 3,000 blockchain transactions

- Up to 4 centralized exchanges

- Up to 3 wallets/chains

- Consultation with a tax accountant

- 8949 report, Schedule D

- Income report

- Missing data analysis

- Tax optimization (FIFO, LIFO, Specific ID)

- Cryptocurrency tax expert support

- Staking, airdrops, and rewards

- Support for DeFi platforms

- FBAR (FinCEN Form 114)

- NFT transactions

- Liquidity pools (LP tokens)

- Cryptocurrency lending/borrowing

- Mining and masternode business

- Futures and leverage trading

- Synthetic tokens

- IDOs/ICOs (Initial Coin Offerings)

- VIP Service (priority list)

PRO

For advanced investors with complex cross-chain investments- Up to 30,000 centralized exchange transactions

- Up to 6,000 blockchain transactions

- Up to 6 centralized exchanges

- Up to 5 wallets/chains

- Consultation with a tax accountant

- 8949 report, Schedule D

- Income report

- Missing data analysis

- Tax optimization (FIFO, LIFO, Specific ID)

- Cryptocurrency tax expert support

- Staking, airdrops, and rewards

- Support for DeFi platforms

- FBAR (FinCEN Form 114)

- NFT transactions

- Liquidity pools (LP tokens)

- Cryptocurrency lending/borrowing

- Mining and masternode business

- Futures and leverage trading

- Synthetic tokens

- IDOs/ICOs (Initial Coin Offerings)

- VIP Service (priority list)

Customized Plan

Big projects require big solutions. Let us help you achieve success. Get customized pricing by scheduling a consultation with a crypto tax expert.

Get Your NFT

Purchase one of our 300 digital accountant NFTs to access exclusive benefits on our crypto tax services!

Each NFT costs 100 USDC (+ gas fee) and can be purchased via the portal below.

How it Works

The NFT Collection

Each NFT is unique and programmatically generated from 3 possible traits: Accountant name, Background Color and Service Discount. All OTM NFTs are unique, and some are rarer than others.

When you buy an OTM NFT, you’re not simply buying an avatar or a probably rare piece of art. You are gaining membership access to a tax accounting club house benefits and offerings will increase over time. Your OTM NFT can serve as your digital identity, and give you access to special benefits at Online Taxman’s community.

Once minted, each owner can visualize the NFT in Opensea and check the discount benefit obtained under the “Boosts” tab.

Rarity

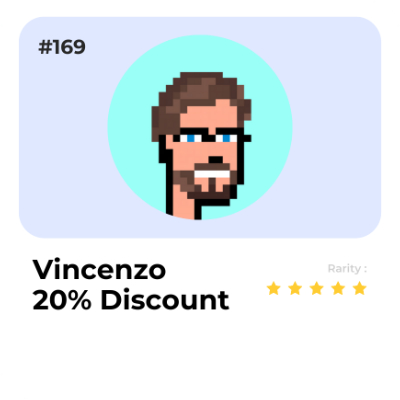

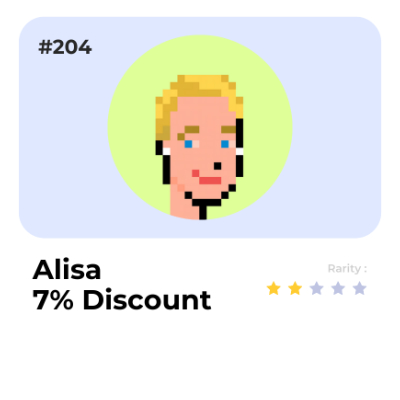

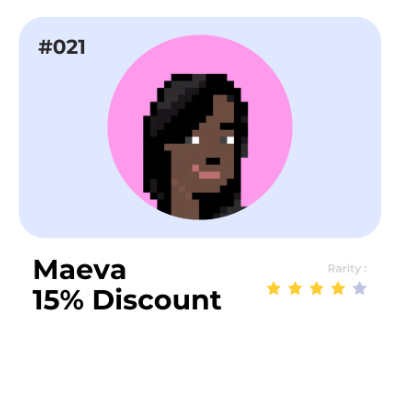

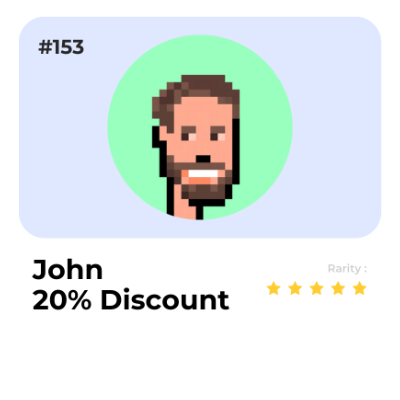

The Online Taxman Collection NFTs have different rarities, with 1 star being the least rare and 5 stars being the rarest. The more stars the greater the benefit.

Next to (or above, if on mobile) is an example showing Vincenzo’s NFTs of different rarities.

Pricing

Each NFT has a fixed price of 100 USDC at Minting stage.

To receive OTM’s community benefits by holding our NFTs, you need to buy them through our website or Opensea, for a price of at least 100 USDC. Purchases below that price will not receive our benefits.

Benefits: Terms & Conditions

The owners of the NFTs are the only beneficiaries of the discounts associated to each piece and are applicable for crypto services only. The discounts are not cumulative and apply to the agreed fees for the crypto service engaged. This means that if NFT owners mint or purchase multiple NFTs, they can only apply one of the discounts received.To apply the discount, NFT owners need to provide OTM with the necessary evidence of ownership at the beginning of the engagement. Once OTM confirms the discount, you can sell the collectible on Opensea and the new owner can start enjoying the NFT’s benefit all over again.

The discount is valid for a single fiscal year. To receive a discount for the following year, you will need to buy another NFT.

When accepting a crypto service, NFT owners can make use of their benefit against the final invoice. For example, if you get a 10% discount and contracted our Standard package for $2000, you will have to pay a 50% retainer to start the engagement ($1000), and the remaining $800 with the final invoice, once the engagement concludes.