Foreign Life Insurance and US Tax: A Guide for Expats

By John Hamilton, CPA

As a US expat working abroad, you may have been offered a foreign life insurance policy. While this may sound like a good idea, it could be fraught with unintended US tax consequences.

Oftentimes the foreign life insurance policy does not meet the strict definition of the IRS for life insurances. Therefore you won’t enjoy the preferential tax treatment of life insurance. Instead, the IRS considers it a foreign financial investment, which can cause various tax and reporting consequences:

- Risk of being a PFIC

- Estate tax

- FBAR and Form 8938 reporting

For example, many financial advisors might try to sell a Malta fund with a life insurance wrapper. Some claim that it is supported by the US – Malta tax treaty, however, this does not apply to all pension plans and life insurance policies coming out of Malta.

When your foreign life insurance is really a PFIC

The biggest negative tax impact occurs if the foreign life insurance turns out to be a PFIC (Passive Foreign Investment Company).

PFICs are subject to punitive and complex tax rules, which aim to discourage US taxpayers from passive investments abroad. US expats need to be aware of and avoid PFICs if possible.

The IRS defines a PFIC as a foreign corporation with:

- either at least 75% of the corporation’s gross income is passive income,

- or at least 50% of the corporation’s assets are passive assets.

Most people assume that they don’t own any PFIC. However, investments outside the US such as mutual funds, even money market funds, insurance policies, and non-US pension plans typically pool foreign investments. Therefore they meet the definition of a PFIC.

If your foreign life insurance does not meet the IRS definition for life insurance and is instead a PFIC, you will have to report all the mutual funds held in the investment on Form 8621. In addition, any time the insurance company buys or sells funds, you have a taxable event under excess distribution rules.

Furthermore, when you die the PFICs inside the policy will be treated as sold and trigger tax as well, subject to excess distribution.

As you can see, PFIC taxation is extremely complex. If you own or suspect you have a PFIC, consult with a knowledgeable tax accountant.

Estate tax on “life insurance” payout

With life insurance, you want to provide to your beneficiaries in the case of your death. However, if the insurance policy does not meet the IRS definition, it will be treated just like any other investment account. As such it is part of the assets that are subject to estate tax.

Financial reporting for foreign life insurance

Foreign life insurance is a foreign financial account that you must report to the IRS and Treasury if it meets certain thresholds.

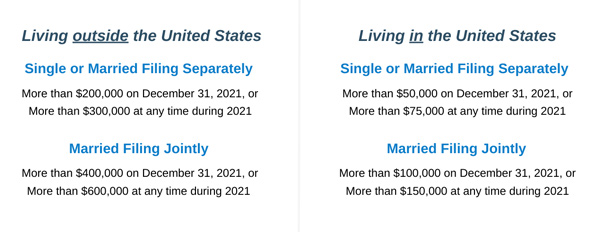

Form 8938

An insurance policy with cash value is a “specified foreign financial account”, which is reported on Form 8938. The thresholds are the following:

FinCen Form 114 (FBAR)

You must include the life insurance in your FinCen 114, also known as FBAR, to report your foreign financial accounts.

Foreign life insurance policies are often not what they seem

As you can see, getting life insurance abroad can be a really bad idea for a US taxpayer. Be aware of IRS taxation of foreign life insurance. US-based policies would offer the same level of insurance but without reporting issues with the IRS and potential taxation issues.

Malta does offer good life insurance policies that fall within the tax-free realm but one must be careful in choosing the policy and program as some are actually taxable.

If you have foreign life insurance and didn’t report it properly, we can help you get back into compliance. Under the information disclosure program, you would need to amend prior returns to disclose those assets along with an explanatory statement.

We have helped hundreds of clients come into compliance under this program and can help you.

Ready to seek assistance with your US taxes?

Filing US taxes as an American abroad is complex. We help make it easy for you.